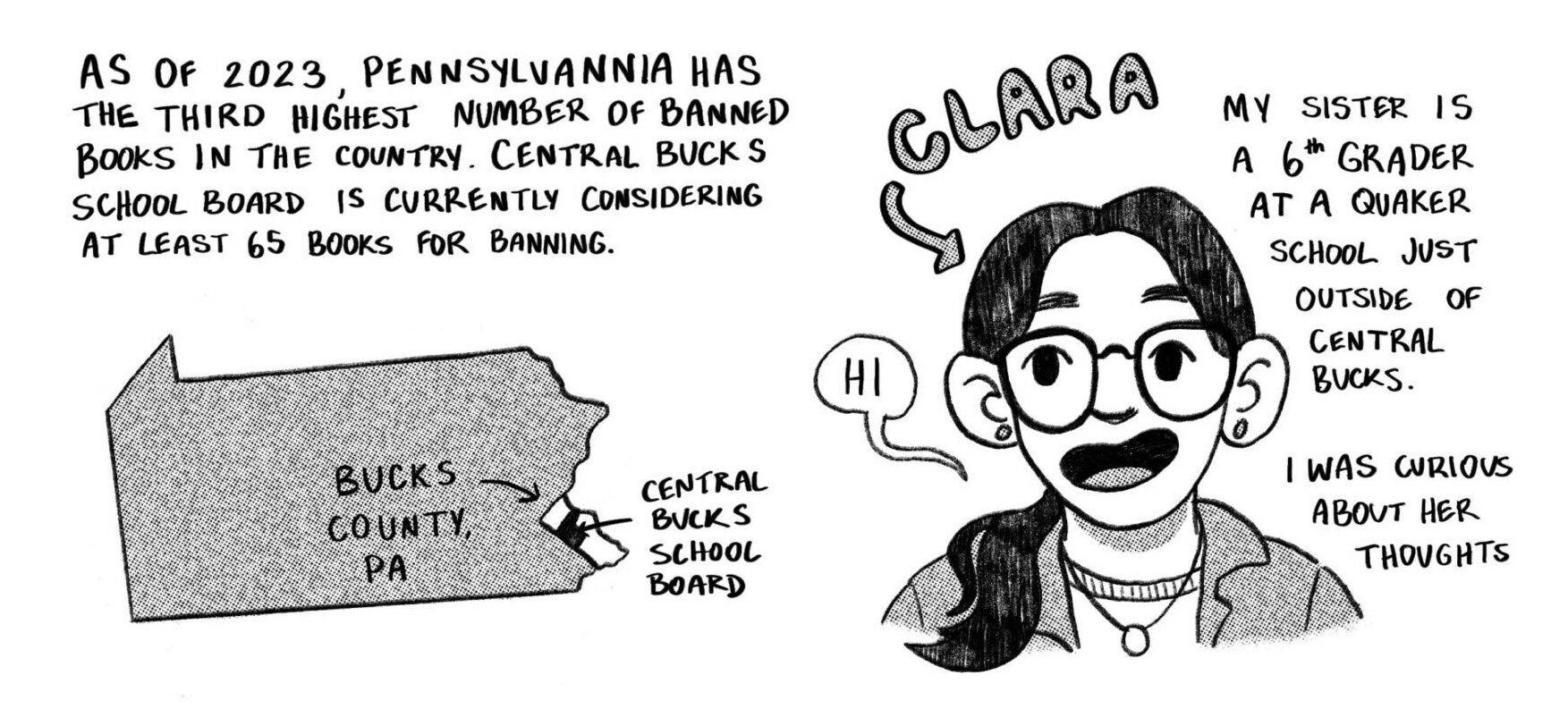

Why SAIC costs so much,

how students are coping

and what Obama’s planning Illustration by Emily Haasch

Illustration by Emily Haasch

“You can’t assume you’ll just jack up tuition every single year,” said President Barack Obama to the cheers of 4,000 students at the University of Michigan in January. “If you can’t stop tuition going up, your funding from taxpayers will go down. We should push colleges to do better; we should hold them accountable if they don’t.”

Considering the economic crisis and the constant hikes in tuition rates nationwide, it is not surprising that Obama would take this mission as a keystone for his reelection campaign.

“I have taken out around $100,000 in student loans,” said Jay Fernandez, a graduate student in the Advanced Painting Department. “At SAIC every day was a battle. I could go days without eating and would usually have to steal my food on a daily basis.” Fed up with the difficulties of a student’s life, he sent a message to school and country authorities. “They don’t understand how hard it is to live right now. Raising tuition in this economy is killing students who could really make the world better.”

In a recent article, the New York Times referred to SAIC as the third most expensive net cost private, non-profit, four year university in the country ($38,965 a year), citing the Department of Education’s Transparency ranking. (Net cost is the total cost of of attendace minus the average amount of government or institutional aid offered.) Out of the five most expensive institutions listed, four are art schools. As Times’ editorial page editor, Andrew Rosenthal, pointed out in the article, “Not only does art not pay, but if you want to study art, you will pay.”

In an effort to listen to students concerns and answer their questions, SAIC authorities organized a Student Town Hall meeting in early February, where they spoke about tuition and the school’s budget, among other issues. Rose Milkowski, vice president of enrollment management, responded to the government’s ranking of SAIC net costs by saying that the federal government chose a methodology* in which they only analyze the part of a school’s student body that receives grants or scholarships, whether they are federal, state or institutionally awarded. “Our philosophy here is to try to give as much aid to as many students as possible, ” she said. But according to her, larger Liberal Arts schools choose to award larger scholarships to a smaller number of people. “Let’s say you’re at a school like Harvard, and they only give ten of their 100 students a full scholarship – if the government is only looking at the cost for those ten students, then Harvard looks cheap when it’s not. It’s because they are not averaging across the whole institution,” Milkowski says. It could also be that SAIC is admitting more students than it can afford to help properly.

In that same meeting, Brian Esker, vice president for finance and administration, made a presentation explaining to students where their tuition goes and presented evidence that SAIC’s average tuition increase of 3.9% over the last two years is well among the range of similar schools like the Rhode Island School of Design (3.9%) and the Pratt Institute in New York (5.9%).

Students also wanted to know if one of the reasons why tuition is so high could be because part of it was being spent at the musuem, to which Esker responded emphatically that the School and the Museum have completely separate budgets that rarely ever mix.

But the time devoted for the Q & A session wasn’t enough for the attendees, who requested a second meeting at which budget issues would be discussed in depth and questions could be raised about the school’s biggest expenses. As an example, one questioner referenced the school president’s $600,000 salary, as reported in the school’s 2010 tax returns, the latest available. School authorities agreed to look for a new date to give students more information. The meeting has not yet been scheduled.

big tuition, big problems…

While in school, it might be possible to block the thought of being thousands of dollars in debt in order to concentrate on studying, but having an empty stomach or being unable to afford a place to live is not as easy to forget.

Chiara Galimberti, single mother of twin girls and MFA 2012 candidate, said to F Newsmagazine, “I asked the school for help to find a house, and to figure out how to set up schooling for my daughters. I was given a pamphlet with a one-paragraph description of a few neighborhoods and was told to look on Craigslist.” Galimberti was disappointed she didn’t receive more help, since she says some other schools in the city have more elaborate programs to help students in complicated situations. “The University of Chicago offers affordable cooperative houses for students and families. Could SAIC devote some resources to a similar project – not downtown, but somewhere affordable – with tuition of over $18,000 a semester? I think so,” she said. Other schools, like UCLA, have also created special programs to assist students in financial crisis.

Last semester, Albert Porto, and Sophia Cho, both SAIC students, worked on a research project about housing issues at the school for Anne Elizabeth Moore’s class, Collaboration: Art as Social Force. A survey that they designed as part of the project, which was answered by over 200 students, showed that some of them are sacrificing their basic needs in order to cover high tuition fees. 30% of the students who responded mention struggling to afford a suitable place to live, and some of them even experienced periods of homelessness. Porto himself went through this experience, having to hide from guards in order to spend nights on campus couches.

“I was seeing students who were saying, ‘Hey, I can’t access the housing system at all because I can’t get together funds for a deposit,’” said Moore. “And, of course, at this same time I saw more and more students dropping out of school for a semester or longer, which is an indication of the same problem.”

As part of the project, Porto and Cho, along with their teacher, met last semester with SAIC authorities Milkowski, Patrick Spence, Assistant Dean of Student Affairs for Campus Life and other school officials, to talk about the issue and to look for a solution. The meeting was more than four months ago, but so far, not much has been done.

Looking for more statistics, F Newsmagazine distributed surveys to learn more about students’ financial issues, and when asked if their basic needs (food, rent, etc.) had been sacrificed in order to pay tuition, a common answer, mainly among undergrads, was “yes.” Students reported, “having to go days on dry cereal and not much else to eat,” as well as having to “turn off the heat in their apartments” as emergency measures to save some money.

looking for solutions…

President Obama offered a plan to reduce college tuition costs nationally by increasing the amount of federal grant money available for low-interest loans. But the part of his proposal that has not been so well received by higher education institutions is linking federal support to a college’s efforts to offer lower net tuition prices or to restrain tuition growth.

His plan would increase federal investment in the Perkins loan program from $1 billion to $8 billion and, according to a White House fact sheet, it would especially benefit colleges that set a “responsible tuition policy.” Higher education institutions would be evaluated as well by the way they prepare graduates to get jobs and pay back their student loans, and their ability to enroll and help low-income students graduate.

But judging colleges to determine the federal aid they deserve might not be an easy, or even a fair task. Colleges that fail to do well in these evaluations would lose millions of dollars in federal aid – and of course, those most affected by this decision would be, again, the students.

Interested in knowing how this proposal would affect SAIC if brought to reality, F Newsmagazine met with Brian Esker, Rose Milkowski, and the school’s Provost Elissa Tenny.

“The educational system is very complex and diverse,” Esker said. “We have public, community and private forms of education, among others. It’s hard to make a plan that can help them all. Several aspects of this proposal have been presented before and they have failed because of these complications.”

“They don’t understand how hard it is

to live right now. Raising tuition in this

economy is killing students who could

really make the world better.”

— Jay Fernandez, graduate student at SAIC

Provost Tenny explained that school authorities have been looking at options for controlling costs. She said the school’s main priority in this respect is to raise more scholarship money for the undergraduate population in particular. About the other part of the plan, where Obama talks about evaluating schools’ efforts in preparing students for getting well-paying jobs, she said that is complicated task when talking about art and design schools, but assured that they’ve been looking for solutions that have included a revision of the Co-Op and Career Services programs, along with the creation of the sophomore studio seminar with its component of professional practices.

“But even with all of that, we know that our costs are high,” she admitted, and listed some of the reasons behind this. “We are in an urban setting and real estate is more expensive here. Many art schools chose to be inside the city in order to be near art and culture scenes, but that is a costly place to be. We also have a low student-faculty ratio (10:1), which is a very expensive model, but one to which SAIC has always been committed in order to offer quality education.”

She said that an art school also depends on expensive equipment, ranging from ceramics, photo or film video and new media and beyond. “And on the graduate level, where we give the students studio space, again we are dealing with expensive real estate prices,” Tenny concluded.

It is clear that the costs of equipment and space are high, but so the ones for engineering students, for example. That still does not explain why art students are receiving less overall aid. Thinking back to the New York Times article, if art schools are far from having the highest tuition rates nationally, why are art schools ranked as the most expensive net cost institutions?

“The entire art and design segment of higher education, in comparison to other segments, does struggle with raising more endowments for scholarships. They are not like an Ivy League school that produces a lot of business people and attorneys who make millions of dollars and who give millions back to their alma maters,” explained Esker. So it apparently all comes back into the difficulty of raising money for the arts.

In regard to the 2010 salary of SAIC’s President – reported to be over $600,000 – Provost Tenny explained, “Any reputable institution has a compensation committee, which looks at what other institutions pay in their sector. “In order to attract the best talent, the institution has to be competitive in that way, so that salary is not really out of line compared to similar institutions.” Columbia College president’s yearly compensation is $568,721 and this number, reported in 990 tax forms, includes the base salary plus a number of extra benefits and compensations.

Looking for more recent numbers, F Newsmagazine asked if the current salary of President Walter Massey could be made public. Tenny responded, “The school doesn’t publish current salaries, but when the 990 tax form comes out, they will become public information.”

Thirty-six of the 519 private college presidents analyzed by the Chronicle of Higher Education make over a million dollars a year.

Education institutions are one of those places where the 99% shares buildings and hallways with the otherwise distant 1%, clear evidence of the nation’s growing economic divide.

*Net Price after Scholarships and Grant Aid, 2008-09

Note: Average net price is generated by subtracting the average amount of federal, state/local government, or institutional grant or scholarship aid from the total cost of attendance. Total cost of attendance is the sum of published tuition and required fees (lower of in-district or in-state, where applicable), books and supplies, and the weighted average for room and board and other expenses.

Average net price is for full-time beginning undergraduate students who received grant or scholarship aid from federal, state or local governments, or the institution.

SOURCE: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS), Fall 2009, Institutional Characteristics component and Spring 2010, Student Financial Aid component.