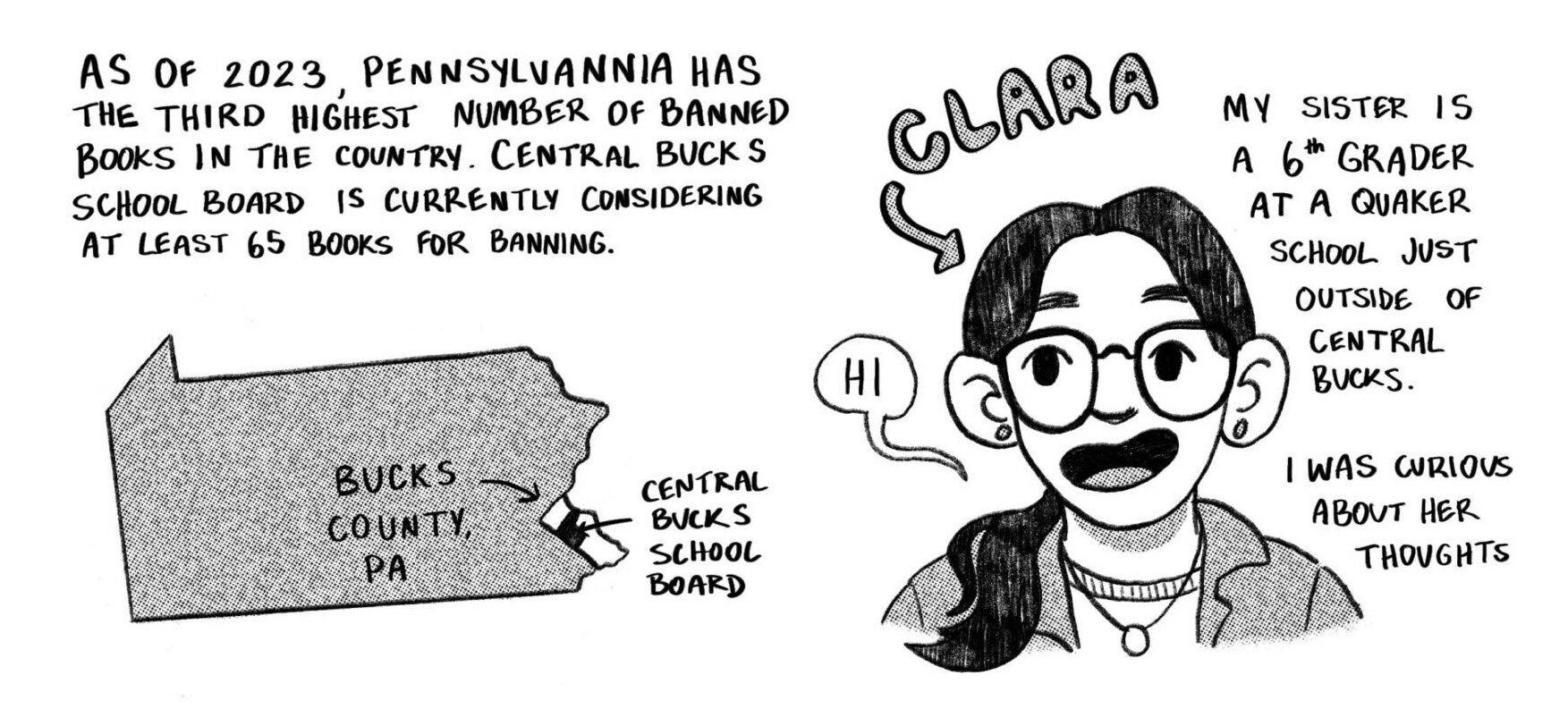

Samantha Rene, pursuing her BFA in Film Video and New Media, has not had it easy. She started classes at SAIC with the help of a need-based grant and a partial scholarship from SAIC, as well as Stafford loans from the federal government to cover the rest of her tuition. After a year and a half, her dad was laid off from his job and Rene could no longer afford college.

The average federal loan debts for SAIC students who graduated in 2010-2011 are:

Grad

Grad

$57,002

70.1% of graduate students who graduated during 2010-2011 had one or more federal loans.

Undergrad

Undergrad

$26,827

56.5% of undergraduate students who graduated during 2010-2011 borrowed one or more federal loans.

Stafford Loan Interest Rates

Note: Graduate Stafford Loans (both subsidized and unsubsidized) have a fixed interest rate of 6.8% through 2013.

2011—20123.4%

Subsidized6.8%

Unsubsidized/ Graduate Rates

2012—20136.8%

Subsidized6.8%

Unsubsidized/ Graduate Rates

She put her studies on hold and worked to save money to go back to school, but after a while her lenders started claiming payment for what she had already borrowed. She paid it off and applied for new loans to continue working toward a degree. Her father found a job and she returned to school this semester, but her father’s higher-paying job lowered her need-based grant, and as a result, she could not afford to be being a full time student. She is currently taking three classes instead of four, and at this rate it will take her seven years instead of four to graduate from college. “Well, at least you’ll graduate,” she recalled being told by a Financial Aid advisor at SAIC.

Rene decided to get a private loan at Chase bank to afford studying full time and be able to graduate sooner. When she is done she would like to go to graduate school, but after only four semesters at SAIC, without even half of the credits she needs to graduate, she already owes $19,085 in Federal loans and her dad, $13,550 to Chase. $32,635 for half of a diploma.

“I went broke trying to become middle class,” reads a handmade sign photographed in Zuccotti Park in New York City during the Occupy Wall Street protests.

The amount owed in student loans has exceeded the national credit card debt, nearing the one trillion mark. And with the price of college tuition at record highs, up an estimated 400% overall since 1982, and the job market still in the toilet, students are graduating without the means to pay off the amount owed. This increasingly bleak economic situation prompts one to question whether or not traditional college education is actually worth a lifetime of financial hardship.

Young people have heard their whole lives that a quality college education and hard work is a certain route to the American Dream – a good job, a nice house, paid-vacations with your family. Well, college graduates, the wait might have to be a little longer than expected to have your white picket fence in the suburbs, unless moving back in with your parents seems like a suitable option. There is a maddening disconnect between our country’s emphasis on higher education and the actual unaffordability of college. Is it smarter to go to college and endure decades of indentured servitude to lenders (if you can get a job, that is), or to skip traditional post-secondary education altogether and risk perpetual bartendom? These seem to be the only choices young people have in these critical times.

Student Opinions

By Mitchell E. Mittelsteat

“I have a federal Pell grant, another need based grant, school scholarships, federal loans, and a private loan. As of this year, I’ll have $13,000 in debt from this school, and $9,000 from my last school. I think it could take me my whole life to pay these off, if not, most likely 20 years or so. America’s tuition is out of control compared to our Western counterparts, I think it needs to be a higher priority that people access education for overall betterment.”

Bronwyn Ariel Isaac, BFA

“I have a scholarship. No loans though. I think college tuition in the US in general is definitely unmanageably expensive. I’m lucky I haven’t had to take out any student loans (yet), but I know countless people who are so deep in debt and it’s just a really bad situation. I’m not sure about whether the high price is worth it. I’m still figuring that out. I want to say yes, but … it’s just so much money.”

Layla Muchnik-Benali, BA

“I have received financial aid from the government and a scholarship from the school. My debt to the school is still at least $35,000, or thereabouts. Frankly, I think that tuition fees, both at SAIC and in the US at large, are ridiculously high. School is worth quite an expense, but it is so out of reach for so many people. Something is flawed when hardworking students can’t pay their debts for education or find a good job with the skills their university gives them.”

Paul Smith, BA

At an expensive art school like SAIC, the dilemma is more pressing, as it is no secret that an art degree usually suggests even more uncertain job prospects. The fact that students keep taking out massive loans despite the situation, raises the question whether or not there is a complete understanding of what borrowing large sums of money entails. “I think a fair share of students nationwide do not really think it out completely,” said Patrick James, Director of Financial Aid at the school. “I felt a big change when the federal government took away the paper loan applications and switched over to the electronic application process,” he said as he explained that the electronic application has made the process much faster, and students devote less time and pay less attention to the debt they are incurring. “We provide detailed information, but I’m not so sure [students] really soak it in,” he commented.

According to the U.S. Department of Education, default rates, have been rising each year since 2005. This is a strange phenomenon, considering experts claim that defaulting on student loans need not be an option. “There is no reason anyone should ever have to go into default, even if they can’t find a job, because there are so many other options,” commented James. “For example, there is a type of repayment plan called IBR or Income Based Repayment. It seems like many students nationwide do not know about it and it is one of the best options out there.” But considering college tuition is at an outrageous high and the unemployment rate is still relatively beefy, the higher default rates are a reality that the government has largely ignored until recently.

On October 26 President Obama announced that he will use executive authority to accelerate Congress’s plan to cap student loan repayment at 10% of discretionary income, total personal income minus personal taxes, for 20 years instead of 25 for “certain individuals.” “The financial aid community is seeking clarity on this,” said James concerning the ambiguity surrounding those eligible for the new program. What has not been widely publicized about the plan is that, as it stands, only active borrowers in 2012 will qualify for this repayment option. While it initially sounds like a needed financial break for those drowning in student loan debt, it does not actually provide any relief to recent graduates. The announcement seems a trivial effort to appease a portion of Obama’s potential voter base. The big elephant in the room seems to go unaddressed – why is it necessary to go into crippling debt for a college education in America when other developed countries offer affordable or even free high quality education?

Illustration by Patrick Jenkins

“It’s not that the U.S. can’t provide free or inexpensive college education. It’s that currently it has chosen not to,” said Sarah Peters, Adjunct Associate professor of Economics in the Liberal Arts Department at SAIC, said to F Newsmagazine. “After World War II and through the 1970s most colleges and universities, especially public but also even select private institutions, were much more affordable,” she explained. Since then, tuition and fees for post-secondary education have grown much faster than the consumer price index (since the early ‘90s almost twice as rapidly), “but no matching increase in government subsidies have been made available.” According to Peters, “Today, with the emphasis on cutting government spending, because of the reluctance of US taxpayers to pay more and the distaste for an increase in government debt, it would require a massive change in U.S. preferences about how to use government funds to imagine much greater government participation in making college affordable.” Emphasizing the need for the American public to value education financing reform, she explains, “the U.S. voters need to be convinced that improved access to higher education and students less burdened by debt upon graduation are essential to everyone’s future well-being, including their own.”

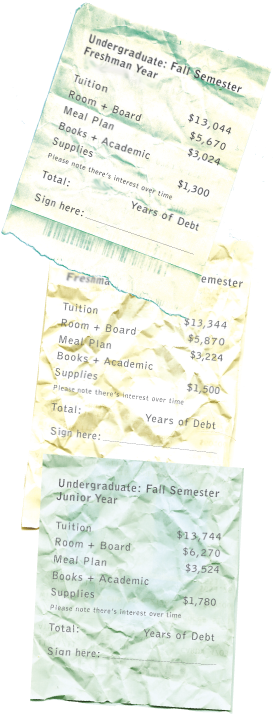

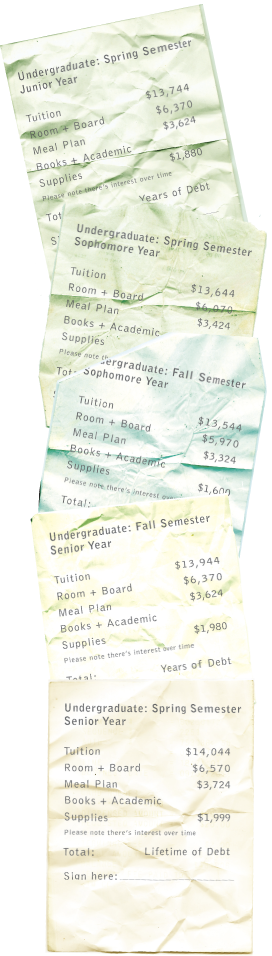

Even if this plan does provide some reprieve for the 2012 borrowers, it does not even remotely address the root of the problem at hand – the outrageous cost of college. Public universities’ tuition fees have gone up an estimated 8.3% since last year, according to a report from the non-profit group, The College Board. Private schools are increasing tuition at an even more alarming rate. For example, from the 2010-2011 school year to the 2011-2012, tuition at the School of the Art Institute of Chicago went up $46 per credit hour for undergraduates and $43 per credit hour for graduate students. That is an increase in tuition of $552 per semester for undergrads and $516 per semester for grads (assuming 4 classes at 3 credit hours each). This may not seem like a starling number at first glance, but if you consider the student population of 2,514 undergrads and 727 grad students, SAIC’s multi-million dollar tuition hike in the span of one school year is mind-blowing.

“The big lenders in the market make far more money when federal loans default, and the guarantors would barely be in business were it not for defaults.”Alan Collinge The federal government has yet to propose a new reform to increase education funding, since the skyrocketing tuition prices are not likely to change. But, why would they? “Taxpayers and other lenders have little risk of losing money on the loans, unlike mortgages made during the real estate bubble,” according to a November 9 story in USA today. “Congress has given the lenders, the government included, broad collection powers, far greater than those of mortgage or credit card lenders. The debt can’t be shed in bankruptcy.”

After intense lobbying from private loan companies, bankruptcy protections for most student loan borrowers were removed with an amendment to the Higher Education Act in 1998. According to an article by Alan Collinge, the creator of StudentLoanJustice.org and author of the book, “The Student Loan Scam,” lenders wanted to ensure more debtors would default on repayments. “The big lenders in the market make far more money when federal loans default, and the guarantors would barely be in business were it not for defaults,” he explains. According to Collinge, many loans have been placed on default before there is any attempt to collect on the debt. “Even the federal government is making a pretty penny on defaults, despite what you’d like to believe,” he writes. According to him, while borrowers are struggling to figure out how to manage their loan debt, lenders are profiting more than ever. Sallie Mae, one of the leading student loan lending companies, disagrees, stating on their website, “No one benefits or profits when people default on their student loans or declare bankruptcy. Lenders lose money, and taxpayers lose money. Federal bankruptcy laws are there to protect you.”

While Occupy Wall Street demands everything from loan repayment reform to complete student loan forgiveness, the crux of the problem – the cost of college – desperately needs government attention. If students are lucky enough to get a job with their diploma, they have to use it to pay off student loans. The government harps on the value of education, but refuses to do anything momentous about the high price of college. As to the estimated 36 million Americans living under the dark cloud of student debt – it’s hard to be hopeful when it’s about to storm.